Former Home Depot CEO issues dire warning for Americans

Something strange is happening in our financial system.

According to analysts at UBS, more than 50,000 retail locations could shut their doors in the months ahead.

Already, Walmart, Foot Locker, Bed Bath & Beyond, and Macy's are cutting stores.

And former Home Depot CEO Bob Nardelli recently issued a grim warning:

“We're going to see a lot of bankruptcies. [This is] different than anything I have seen in my 52 years…”

What does it all mean for your family and your money?

Dr. Nomi Prins has dug deeper into the research, and she's found something startling.

Amid all the turmoil predicted by Nardeni and UBS, Prins has found a single firm that could be the canary in the coal mine foreshadowing the next major crisis in America.

All it takes is one look at this troubling chart to see why –

Dr. Prins says:

“This chart tells you everything you need to know about the next crisis in America.

In short, what we're about to see is a currency crisis – but not the kind of currency crisis most folks expect.

This firm – along with many others – will almost certainly go bankrupt as a result.”

According to Dr. Prins, our money is about to change forever… and the overhaul is set to happen in just a few weeks.

To help folks prepare, she's recorded a briefing that explains all the details of what she calls a ‘reset' to our financial system. In it, she lays out all the evidence of this currency crisis, and what you can do to prepare.

Click here now to see her full (and free) presentation.

In today’s Market 360, we’ll review all the big economic reports and dive deeper into the Federal Open Market Committee (FOMC) meeting. And with the important data now behind us, I’ll also share what you need to do next…

All of the big economic data is in – and it was largely positive this week.

The Consumer Price Index (CPI) and Producer Price Index (PPI) revealed that inflation has cooled dramatically at the consumer and wholesale level. Retail sales rose slightly in May, crushing economists’ expectations for a decline. And the Federal Reserve “paused” key interest rate hikes in a move to give members more time to assess recent data.

So, in today’s Market 360, we’ll review all the big economic reports and dive deeper into the Federal Open Market Committee (FOMC) meeting. And with the important data now behind us, I’ll also share what you need to do next…

Consumer Price Index

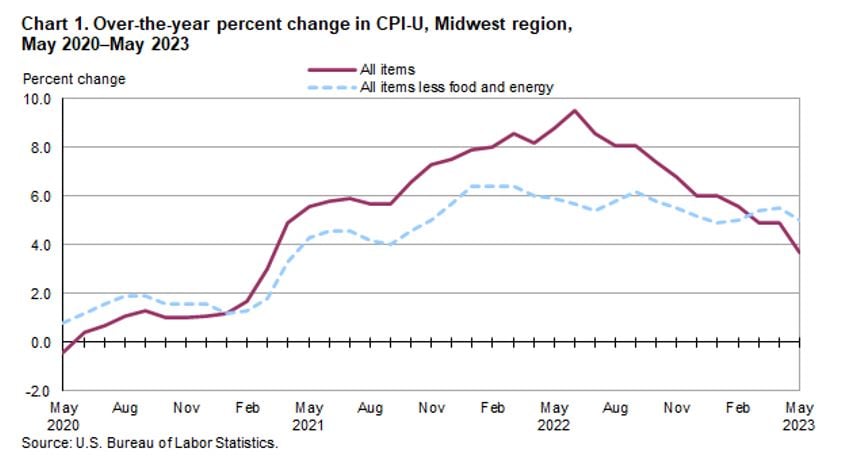

First, the CPI has declined for 11-straight months. According to the U.S. Labor Department, headline inflation rose 0.1% in May, which pulled the annual pace of inflation back down to 4%. That compares to a 4.9% annual pace in April and a peak of 9.1% in June 2022. So, even though inflation remains above the Fed’s 2% target, headline CPI has been cut by more than half in the past 12 months.

Core CPI, which excludes the more volatile food and energy prices, increased 0.4% in May and remained at a 5.3% annual pace. That was in line with economists’ expectations. Notably, food prices only rose 0.2% in May, while energy prices declined 3.6%. The cost of housing – as measured by Owners’ Equivalent Rent (OER) – remains stubbornly high, up 0.6% in May.

But overall, the May CPI was the lowest pace for consumer inflation since April 2021.

Producer Price Index

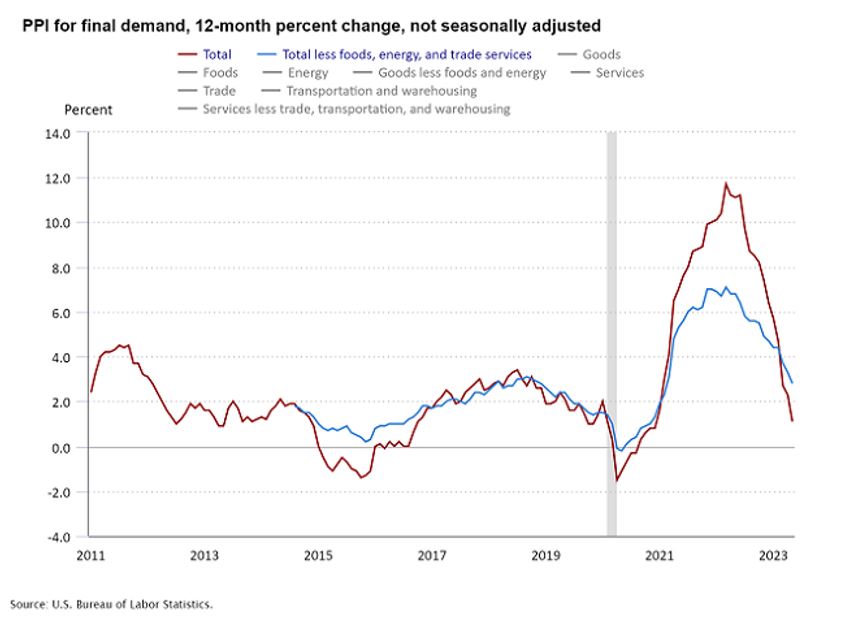

The PPI declined 0.3% in May, representing the third drop in the past four months. The decline contributed to a rapid deceleration in the annual rate, which is now up only 1.1% in the past 12 months. In comparison, the PPI was at a 2.3% annual pace in April.

Core PPI, which excludes food, energy and trade margins, was unchanged in May and up 2.8% in the past 12 months. Wholesale food prices declined 0.7% in May, and wholesale energy prices dropped 6.8%. Interestingly, wholesale services prices only rose 0.2% in May after a 0.7% increase in April.

The bottom line: Consumer and wholesale inflation is decelerating rapidly, which made Wall Street more confident that the Fed would hit the pause button on raising key interest rates.

And that’s exactly what the Fed did.

The FOMC Meeting

FOMC members voted unanimously to “pause” key interest rate hikes on Wednesday afternoon, which was widely expected. The FOMC statement notes:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5 to 5-1/4 percent. Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy.

However, analysts didn’t expect the Fed’s “dot plot” to reveal that more rate hikes were forthcoming. Based on the Fed’s dot plot chart and FOMC members’ projections, we can now anticipate interest rates to be as high as 5.6% by the end of the year. That would mean two more rate hikes.

So, the dot plot and FOMC statement squashed investors’ initial enthusiasm over the pause and sent the market spiraling lower on Wednesday afternoon.

But in a strange twist of events, Fed Chair Jerome Powell calmed the markets with some dovish comments.

Typically, Powell’s comments have the exact opposite effect on the stock market, as he often talks out of both sides of his mouth. But this week, Powell gave investors hope that the pace of key interest rate hikes was slowing – if not done completely – as he signaled inflation was finally starting to back off closer to the Fed’s 2% target.

Powell stated that July’s FOMC meeting will involve a “live” interest rate decision, in that the Fed will remain data-dependent and make a decision about whether to raise rates that day. In other words, if inflation continues to cool off, the Fed will likely continue to pause.

Even more dovish is the fact that Powell did not state the Fed would raise rates at the next meeting in July. He even backtracked his initial statement that June was a “skip,” revising his comment to state, “I shouldn’t call it a skip.” These hints give investors hope that another hike is not baked in the cake for July.

May Retail Sales Report

The cherry on the economic report cake was the May retail sales report.

The U.S. Commerce Department reported on Thursday that retail sales rose 0.3% in May, thanks to an increase in vehicle and parts sales. This crushed economists’ expectations for a 0.1% decline in May retail sales. Ten of the 13 categories showed an increase in May, as spending on building materials and vehicles picked back up. So, Americans remain resilient despite elevated inflation and higher interest rates, and an economic recovery is underway.

Here’s How to Get an Edge on Wall Street

Overall, a lot of the concerns that have weighed on investors’ minds this year – the Fed, rising rates, elevated inflation and slowing economic growth – are finally starting to ease. So, I expect a lot of cash that’s been sitting on the sidelines to pour into the market.

And if you want to get an edge on Wall Street to capitalize on this coming influx of cash, you’ll want to listen to what Keith Kaplan, CEO of InvestorPlace partner company TradeSmith, has to say.

Keith and his team of 36 data scientists, software engineers, and investment analysts have created a system that has strong predictive ability over the short term (around 30 days). They call it… Project An-E.

Next Tuesday, June 20, at 8 p.m. Eastern time, Keith and I are sitting down for our live AI Predictive Project event to discuss how Project An-E works… and how it can give investors a big edge in the markets. If you haven’t registered yet, there’s still time. Just click here to sign up and reserve your spot now.

Sincerely,

Louis Navellier

Senior Investment Analyst, InvestorPlace

IRS loophole allows ANYONE to collect up to $28,544 before Sept. 10th

These folks got it made!

Thanks to a little-known IRS loophole…

They are collecting huge payouts from government-regulated “royalty programs”… every single year!

“Started from a zero balance… Just hit $1,200 a month in [royalties].” -Neil P.

Like Neil P., who is now collecting $1,200 a month in “royalties.”

“Increased my [royalties] to over $30,000 last year.” -Tom K.

Tom K. reports he's making $30,000 a year!

“Increased my [royalties] from about $2,000 to $60,000…” -Elaine T.

And Elaine T. boosted her payouts to $60,000 per year!

If you want to participate, you'd better hurry.

The next payout deadline is coming fast.