The Wedbush ETFMG Video Game Tech ETF (NYSEARCA: GAMR) tracks an equity index of global firms that support, create or use video games.

The stocks held in the portfolio are assigned to pure play, non-pure play or conglomerate baskets, and weighted equally within each. GAMR assigning stocks into various categories is a common allocation in exchange-traded funds (ETFs) with narrow themes.

The fund’s holdings can be divided into three categories, with the “pure-play bucket” holding hardware and software game developers, including virtual reality firms; the “non-pure-play bucket” is for stocks that support the pure-play firms with intellectual property (IP); and the “conglomerate bucket” features large stocks that more broadly support the video game space.

With the index provider making these assignments, GAMR is heavily weighted in the first two buckets that encompass 90% of its holdings and are apportioned by market-capitalization relative to the whole index. Conglomerates get just 10% which keeps big, diffuse names from dominating its overall holdings. Stocks within each individual bucket are equally weighted. The ETF charges a somewhat high fee, which is not unusual for narrow niche funds with little competition.

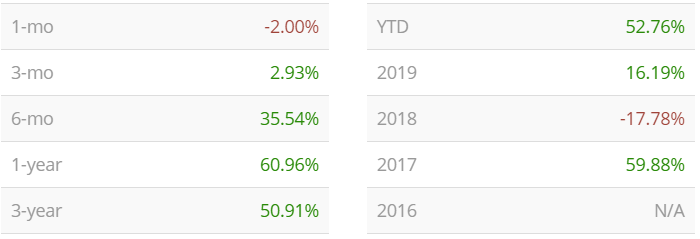

The ETF has had impressive returns for the last few years as the image below shows.

Source: Stocknews.com

The fund has $132 million in assets under management, a 0.20% average spread and 91 holdings. Its expense ratio is 0.75%, meaning it is expensive to hold relative to other exchange-traded funds. With a yield of 0.58%, it last paid a dividend of $0.21 on Sept. 15. GAMR currently trades around $68.

Continue reading here

Why Tesla Is On Its Deathbed

Electric cars are about to become a thing of the past…

Which might sound crazy considering that they’re relatively new.

But thanks to a new discovery — known as “Blue Gas” — companies that produce electric cars (like Tesla) are about to go down in flames.

See, “Blue Gas” is 100% emission free, can propel vehicles hundreds of miles, and allows cars to fully charge in just minutes.

So it should come as no surprise that projections for “Blue Gas” vehicles are sky high.

In fact, in the next few years, predictions have it that there will be more than 10 million “Blue Gas” vehicles on the road…

A statistic that prompted Bloomberg to project that “Blue Gas” will “skyrocket 1,000 times over.”

The thing is, “Blue Gas” is slated to go global soon.

And the tiny company driving the “Blue Gas” industry is primed to absolutely shatter any gains ever paid out by Tesla.

So there’s no time to wait. The time to get in is NOW.

Click here before this stock goes from a few dollars to $350 in the coming months.