Right now, all the most explosive profit opportunity is concentrated in one small segment of the stock market…

Penny stocks.

These cheap stocks are not for everyone, and require a solid risk management approach. But only stocks selling for under $5/share can provide true “lotto ticket” gains – blowing Amazon, Microsoft, and even Tesla out of the water.

See Also: $3 Tech Stock the Next Tesla?

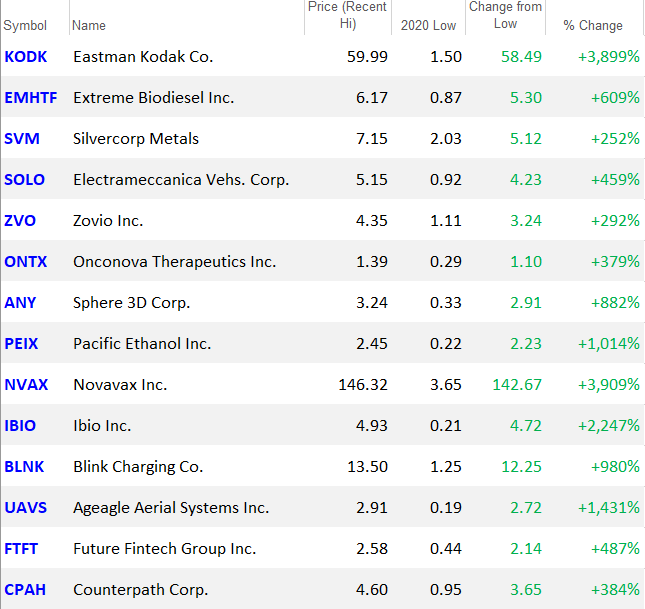

Dozens of tiny stocks are capitalizing on this mad rush in 2020, and already we've seen real gains of 292%… 379%… 1,014%… 3,899%…

And more than a few Mega-Gains have blown to the top of our Penny Stock Hotlist (below).

So the big question is, of course, what should a penny stock investor buy now?

The answer, for many, is still penny stocks…. and our new hotlist (below) is an excellent tool.

Not only is a stock trading below $5 a share much more affordable for regular investors… but cheaper stocks also tend to belong to smaller companies, who can double or triple in size much easier than a giant like Amazon.

Related: Tesla Killer Launches 90,900% Market Surge

In fact, some of the greatest companies in the world used to be tiny stocks themselves. Amazon traded for less than $2 a share in 1997. Now it's over $3,000.

Of course, with higher potential reward comes higher risk. Smaller companies and cheaper stocks means there’s more volatility and more room for bad actors to influence stock prices, so please exercise caution, and keep an eye on your trades.

These cheap stocks can go from slumber to life-changing jackpot – and sometimes back down again – in a matter of days, sometimes hours.

With that being said, below is our vetted list of the 10 best cheap stocks to buy right now:

The #1 Biotech Stock Of 2020 (New Report)

1. Quantum Computing Inc. (QUBT) – $2.50/share

Quantum computers are a new kind of machine that relies on quantum physics to solve in minutes mathematical problems that regular computers sometimes may have to spend millions of years on.

So far, quantum computers are mostly theoretical, with only small and simple experimental devices being created. But already, computer scientists and mathematicians have shown what quantum computers will make possible: finding new drugs in a computer instead of a lab, at fractions of the cost and time we spend right now; designing new materials to resist heat, protect us from damage, or make for super-efficient car batteries; new advances in secure messaging, finance, and defense; and so much more.

All the Big Tech companies have already poured billions into this research, and projections say it will be years or even decades before quantum computing is affordable for smaller companies.

That’s where Quantum Computing Inc. (QUBT) comes in. The firm develops and sells software that allows you to run quantum computing calculations on traditional computers. While slower, many of these calculations can still be run at a reasonable pace. QUBT is aiming to fill the gap left by the Big Tech players, and give smaller businesses that can’t afford an experimental quantum computer a low-cost way to make use of the quantum computing revolution.

The company already has three software packages in beta testing, and is expecting to start selling them in late 2020 to financial, healthcare, and government customers. Getting in before those contracts start hitting the news could land you a jackpot.

2. Agenus Inc. (AGEN) – $3.75/share

Early-stage biotech companies can be some of the most profitable cheap stocks – provided you sort the wheat from the chaff.

Without a crystal ball that can be very hard to do, but with Agenus Inc. (AGEN), the market may have done it for us. On August 6 the biotech focusing on immunotherapy against cancer released earnings, reporting $26 million in quarterly sales when analysts were expecting just $9.33 million.

The stock jumped 15% the next day, and still looks bullish, especially with two FDA filings still due in 2020. As an extra bonus, it’s rare to find a cheap biotech stock that’s already making money. That added bit of safety mBiotech akes this a great opportunity.

3. Newmark Group Inc. (NMRK) – $4.45/share

Newmark is one of America’s main real estate advisory firms. Better known under their operating name of Newmark Knight Frank, this company helps its clients at every step – from strategy, selecting sites, designing and building properties, to filling and running them, and even selling them.

Despite the Covid-19 downturn at the beginning of 2020, Newmark still posted impressive revenues of $383.7 million in Q2. With the real estate market now recovering even as companies consolidate, Newmark is set to bounce back.

4. Electrameccanica Vehicles Corp. (SOLO) – $3/share

Electric vehicles are clearly making huge inroads, in large part due to Tesla Inc. (TSLA) and every other car manufacturer is struggling to catch up.

But something’s not right when Tesla, which makes about 350,000 cars a year, is now valued higher than Toyota Motor Corp. (TM), which makes 10 million of them. Not to mention that at almost $1,500 a share, Tesla’s shares are far from accessible.

So instead, I suggest Electrameccanica Vehicles Corp. (SOLO). Based in Canada, this electric car company is one of the few Tesla contenders with an actual product out there, a one-seater electric car. That already puts it a step ahead of most of the industry, and the company is moving quickly to start production of more practical cars.

5. American Lithium Corp. (LIACF) – $1.30/share

It’s no secret that the meteoric rise of electric vehicles is fueling a gold rush in lithium, the element used in high-capacity batteries.

The vast majority of lithium comes from South America, but as more and more cars go electric, demand is expected to outpace current supply. Experts think the electric car industry is overdue to start buying up lithium mines to guarantee their supply – and lock competitors out.

American Lithium Corp. (LIACF) is a speculative play that owns a promising lithium deposit in Nevada, just four hours drive away from Tesla’s Gigafactory. The company’s management is banking on being bought out by Tesla. It’s a speculative and volatile space, but the potential upside is extraordinary.

6. Fosterville South Exploration Ltd. (FSXLF) – $3.40/share

One commodity that’s already breaking records is gold, which went above $2,000/ounce for the first time ever in early August. With unprecedented money-printing from the U.S. as well as governments across the world, all desperate to get out of the economic crisis caused by the Covid-19 pandemic, currencies everywhere are being devalued.

In fact, in just a few months in 2020 the Fed pumped in more stimulus into the economy than it did through years following the 2008 Financial Crisis. And there’s no end in sight for this stimulus yet.

That means ever more dollars chasing the pretty much the same amount of gold. So no wonder gold prices are going up.

One of the best ways to play this is Fosterville South Exploration Ltd. (FSXLF), which owns several potential gold deposits including three that are adjacent to the highest quality, lowest-cost gold mines in the world.

As stimulus and money printing keep pushing up the price of gold, Fosterville will follow.

7. VistaGen Therapeutics Inc. (VTGN) – $0.90/share

During the Covid-19 pandemic and the related lockdowns, anxiety has skyrocketed. In fact, the Census Bureau says that one third of Americans are now showing signs of clinical depression and anxiety.

VistaGen Therapeutics Inc. (VTGN) is an early-stage biotech company that just finalized it’s Phase 3 study design with the FDA. The firm will be testing a completely new kind of treatment for anxiety – a nasal spray that begins acting almost immediately, rather than the 2+ weeks of regular treatment.

Co-licensing deals also mean that VistaGen is set to receive milestone payments for this drug of up to $172 million even before it starts selling.

8. Corporate Office Properties Trust (OFC) – $27.50/share

Real estate investment trust stock price were hit hard in early 2020 when the Covid panic first struck. But this indiscriminate selling plunged the share prices of some trusts that were actually immune to the crisis.

Corporate Office Properties Trust (OFC) is one of them. This trust operates only in and around Washington, D.C., and owns offices, data centers, and the like for government agencies, defense and intelligence outfits, and contractors. In fact, OFC’s top tenant is the federal General Services Administration, which handles leases for most federal agencies. This one tenant accounts for 34% of OFC’s 2019 revenue. That’s not going away anytime soon, Covid or not.

Filling out the top three tenants are Amazon.com Inc. (AMZN), and defense contractor General Dynamics Corp. (GD). Both are as safe as tenants can get.

9. Nokia Corp. (NOK) – $5/share

With Europe now joining the Trump administration in banning China’s Huawei telecom giant from participating in the rollout of 5G in the West, that’s left two main contenders for the 5G crown.

One is Swedish Telefonaktiebolaget LM Ericsson (ERIC), long the favorite. But Ericsson is overplayed. Neighboring Finland’s Nokia Corp. (NOK) has the advantage of cheaper shares, nimbler operations, and most importantly – low expectations.

Those low expectations already saw Nokia shares jump 15% on an unexpectedly good Q2 2020 earnings report. But with Huawei now out of the picture, Nokia is set to do even better.

10. Exela Technologies Inc. (XELA) – $0.60/share

The Covid-19 lockdowns have accelerated the push for businesses to digitize their communications, bookkeeping, payment systems, and more. With millions of people now working from home and ordering almost exclusively online, going digital is the only way for companies to survive.

Exela Technologies Inc. (XELA) is a business software company that specializes in custom automation solutions for businesses. This includes things like evaluating and tracking job applicants, handling billing, digitizing physical mailrooms, payment processing, and much more.

In July, the Request to Pay system, co-developed by Exela and Mastercard Inc. (MA), was adopted by one of the UK’s leading retail payment authorities. This will allow billers to safely communicate and make payments over the cloud, safer and more convenient than before.

Ever since this announcement, Exela’s stock has been rising. But in early August, the firm released its new digital signature solution, DrySign, which allows for secure, legally binding digital signatures to be exchanged across the world, with specific conditions. As the Covid-19 crisis continues, this hands-free way of signing documents could speed up Exela’s rise even more.