By Matthew Clark, Money & Markets, LLC, 2024-05-23

Say what you might about new Argentina President Javier Milei, but he and his government have several critical tasks at hand:

- Tame inflation of over 250%.

- Reduce the federal deficit.

- Reduce the country's 57% poverty rate.

The problem is that solving one issue affects the others.

Milei's government has launched an aggressive austerity campaign to help curb inflation.

Those efforts include cutting government subsidies, closing state-run institutions and auditing welfare programs.

Subsidies and public programs help impoverished people afford to buy goods. Cutting those subsidies reduces the federal deficit, but it also cuts low-income households off from the help they need.

Earlier this year, Argentina announced a plan to increase its natural gas rates by 100% to reduce some of those government subsidies for its booming gas and energy sectors.

The idea is that a rate increase will help Argentina's natural gas companies invest more in boosting production.

For one company, the plan is working.

Natural Gas Is Big Business in Argentina

In 2021, natural gas generated 93.3 terawatt-hours of electricity in Argentina — or roughly 63% of the nation's total power generation.

The following year, that dipped as renewables like wind and solar gained traction:

Despite that reduction, the trend remains the same. Natural gas still rules the roost when it comes to electricity generation in Argentina.

One reason gas has been king is price. In January 2024, the Argentine government said 82.5% of customers pay just $0.70 per metric million British thermal units (MMBtu). The remaining 17.5% pay more than 5X that at $4/MMBtu.

The lower prices paid by most Argentinians have left the country's natural gas industry underfinanced, slowing down projects to expand capacity in the large shale deposits of Vaca Muerta.

The latest government measures to trim subsidies and increase natural gas costs should increase company profits and allow for more expansion.

One natural gas company is already taking advantage of these austerity measures.

The Bullish Play in Argentina's Natural Gas Sector

Transportadora De Gas Del Sur TGS (NYSE: TGS) is an Argentinian company that produces, transports and sells natural gas in South America.

Business was good even before the government announced new austerity measures, and it's been even better since…

In the first quarter of 2024, TGS reported a 6% jump in total revenue year over year and a 19.5% increase in its operating profit.

That's triggered a solid rally since March:

From its recent low, TGS stock has gained more than 60% to close in on a new 52-week high.

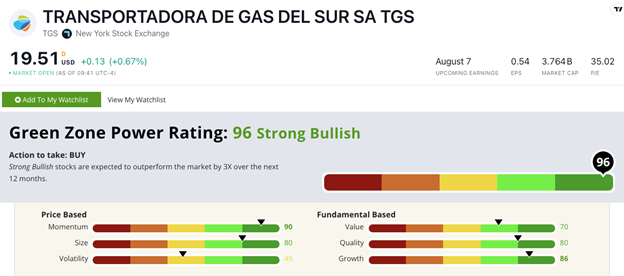

Looking at its Green Zone Power Ratings, it looks even better than it did back in 2022:

TGS' Green Zone Power Ratings in May 2024.

TGS rates 96 out of 100 on Adam's system — putting it in the top 4% of all stocks we rate.

The stock scores a 90 on Momentum (it was 89 back in 2022) and 86 on Growth (a huge improvement from 58 in 2022).

TGS is more volatile due in part to the political shakeup, and its surge in price has lowered the Value factor rating from 99 to 70.

Bottom line: TGS is just as good a stock as it was when I wrote about it two years ago. Heck, it might be even better.

The new austerity measures in Argentina, while a tough pill to swallow for now, are providing massive growth in revenue and profits for TGS.

With these policy changes in place — and the prospect of even more — TGS should have a bright future. Pair that with “Strong Bullish” Green Zone Power Ratings, and this is a stock to consider for your portfolio.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets