The Coronavirus has swept the world, with country after country going into full lockdown, closing borders, halting travel, shutting businesses, and telling people to stay indoors.

Not even the Federal Reserve's historic $1.5 trillion intervention could prevent panic across the boards – resulting in a 30% gutting of the S&P 500.

And smart investors know just what to do now.

Because when stock prices plummet, dividend yields explode upward.

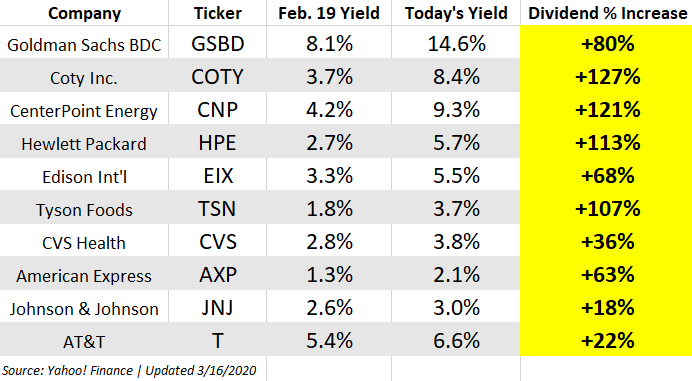

Here’s a look at our list of the top 10 stocks currently paying massively inflated dividend yields:

Now let's take a look at some highlights on that list, including the “fire sale” stock prices and why we expect them to hold strong and recover quick…

Dividend Stock #1: Goldman Sachs BDC (GSBD)

This business development company (BDC) is a closed-end fund that makes money by loaning to and investing in private companies, mostly in the U.S. It holds interests worth $10mm-75mm in 106 business that run the gamut from software to media to construction to household products – in a word, everything – and pays shareholders a 45-cent quarterly dividend from its earnings. The stock has fallen 50% in the crash, causing the yield to explode and making it an attractive income play. Though there is a risk some of its holdings may default, GSBD should have the diversification to hold tough. (Click here to learn more about BDCs.)

Dividend Stock #2: Coty Inc. (COTY)

Coty is a giant in the beauty products world, with 70+ brands like Clairol, Good Hair Day, and OPI nail care, as well as a controlling interest in Kylie Jenner's cosmetics empire. Large outlays for brand partnerships has hampered its profitability, and the stock's been cut in half in this crash, but we think that's a massive overreaction. After all, with its e-commerce segment growing 20% YOY, online sales should remain strong.

Dividend Stock #3: CenterPoint Energy (CNP)

CenterPoint is a $35 billion natgas and electric utility HQed in Houston with a 150-year track record. It now serves some 7 million residential and business customers in eight states. While we imagine lights will be out at some businesses, potentially impacting Q1 and Q2/2020 earnings, this stalwart of the energy game isn't going anywhere. This is one bill consumers classify in the “necessary” category, so an economic downturn won't touch it. Moreover, CenterPoint's expanding customer base, clean-energy projects (including a partnership with Ford to develop electric cars), and commitment to increasing its dividend (4.2% CAGR over the last 10 years) should shore up the stock price. [Editor's Note: Edison Int'l is a good bet for many of the same reasons, but we're highlighting CenterPoint for its higher potential upside and screaming dividend.]

Dividend Stock #4: Hewlett Packard (HPE)

Everyone knows HP, the $20 billion computer hardware company and Silicon Valley OG. But HPE is the 2015 spinoff focused on enterprise services and financial services – and it's actually got far more upside. That's because those services include many of the tech investing buzzwords that get our greed glands going (AI, blockchain, cloud computing, and Internet of Things). Take this opportunity to scoop up HPE at a 40% discount from where it was trading just weeks ago, with a 100% higher dividend yield to boot.

[Tech News] A groundbreaking new technology is expected to be in every household in America by the end of this year… This technology has the potential to make over 266 million smartphones become obsolete, forcing nearly every American to switch over to this new “5G Device.” Learn more about it in this video.

Dividend Stock #5: CVS Health (CVS)

Most people who catch the coronavirus don’t need to go to the hospital. But even mild symptoms will require painkillers and tissues. And as everyone is panicking, the sales of disinfectants, hand sanitizers, and so on are rising. That’s why even amid this market rout, pharmacy chain CVS Health Corp. (CVS) is holding tough. CVS is already the leading drugstore in the U.S., with profits and revenues expected to grow for years on the back of its HealthHUB initiative. This plan turns pharmacies into urgent care clinics open on nights and weekends, where some minor illnesses and chronic conditions can be managed. These clinics may also see increased revenues as the coronavirus outbreak spreads here in the U.S. in earnest. The success of HealthHUBs made 2019 a great year for CVS, and once the market rout is over, it will continue to do so. In the meantime, take advantage of the 36% higher dividend yield.

Bonus Pick – Gold, Gold, Gold

Once you've taken full advantage of these once-in-a-generation dividends, consider gold… Perhaps the best way to play this Coronavirus panic is this $7 gold investment that could hand investors a small fortune as gold soars.

It's not gold coins, bullion, or risky mining stocks… This unique gold strategy, with a proven history of soaring 4,500% is Hard-Money expert's “Favorite gold play for 2020.”

To find out more, click here.

After the Crash… What the Future Holds for the Markets

No one believed Porter Stansberry when he said GM would fall apart… or that the same would happen to General Growth Properties (America's biggest mall owner)… or that oil would fall from over $100 per barrel to less than $40 a barrel.

No one believed him years ago when he said the world's largest mortgage bankers (Fannie Mae and Freddie Mac) would soon go bankrupt.

But in each case, that's exactly what happened.

And now, Stansberry says something new and even bigger is quietly unfolding in America (watch his video clip here):

In short: A terrifying new trend is creating thousands of new millionaires (Barron's estimates 20,000 to 200,000 so far) while at the same time destroying the financial future for many others.

Stansberry says this new trend is going to cause tens of millions of people to lose their jobs… it will also cause many major bankruptcies… yet at the same time it will make millions of others, incredibly rich.

Don't get left behind. Get the facts for yourself here.