By Matthew Clark,Money & Markets, LLC, 2024-08-29

Here is the edited HTML with all subheadings using H3 tags and any ticker symbols linked to the specified URL:

Editor's Note: After Nvidia's blockbuster earnings report, Matt wanted to highlight how it all started 30 years ago. Read on…

Innovation With a Side of Bacon

Sometimes, innovation comes from the most unlikely of places.

Yesterday, I shared with you how James Watt revolutionized the steam engine while tinkering in a basement at the University of Glasgow.

Or how about in 1945 … Raytheon engineer Percy Spencer was experimenting with a radar-related vacuum tube for the aircraft manufacturer.

During the experiment, he noticed a candy bar was melting in his pocket. That led Spencer to patent one of the most widely used appliances in the world … the microwave.

There are hundreds of stories tracing revolutionary ideas to odd beginnings.

Like penicillin being discovered after Alexander Fleming left his laboratory a mess in 1928. When he returned from vacation, mold had grown in some petri dishes. That mold led to one of the most transformative vaccines in medicine today.

Even now, one of the biggest technology companies and its cornerstone creation was conjured in the last place you'd think…

The “Grand Slam” of Technology

The “Grand Slam” of Technology

In 1993, Jensen Huang, Chris Malachowsky and Curtis Priem gathered in the corner booth of a San Jose, California, restaurant to talk about an idea that would eventually change the landscape of technology.

The three friends had an idea to create a microchip that would enable three-dimensional graphics on computers.

At the time, computers and early gaming systems were only capable of producing graphics in two dimensions.

Their idea would change the gaming industry and technology as a whole.

And to think, it all started in a booth at their local Denny's. The three founded Nvidia Corp. (Nasdaq: NVDA), and their 3D chips would go on to fuel the artificial intelligence (AI) revolution 30 years later.

But Denny's had a deeper connection to the $2.3 trillion company.

When he was 15, Huang got his first job at a Denny's in Portland, Oregon. He began as a dishwasher and later became a waiter.

In 2023, the three friends returned to the Denny's on Berryessa Road in San Jose, where Huang talked about the early experience of working at Denny's:

It teaches you humility, it teaches you hard work, it teaches you hospitality.

Those lessons likely helped the Nvidia CEO on his journey to leading a company that is now the face of AI.

Nvidia's 3D chips have become an institutional part of the rise in AI because its graphic processing units (GPUs) can handle AI's intensive data processing needs.

However, after the NVDA stock's dominant run, investors want to know if it will continue.

That's where Green Zone Power Ratings comes in.

Green Zone Power Ratings Journey: NVDA Stock

NVDA Slips but Remains “Bullish”

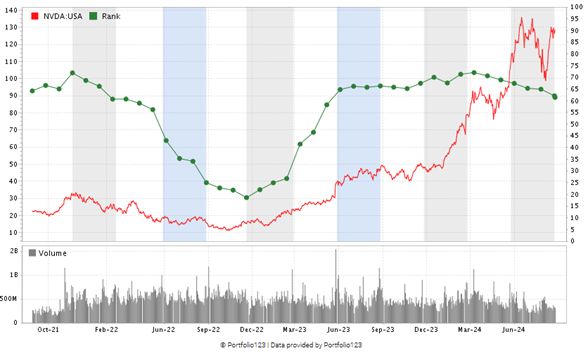

Here's how NVDA has performed — not just its share price but its performance in the Green Zone Power Ratings system.

This chart shows its “ratings journey” over the last three years:

NVDA‘s ratings (green line) fell beginning in late 2021, reaching “Bearish” territory in the fall of 2022. However, after the release of ChatGPT — and the news that NVIDA's GPU chips were instrumental in the race to grow AI — its fortunes changed.

The surge in share price, coupled with the bolstering of its fundamentals (think, value, quality and growth), NVDA resumed its place in “Bullish” territory in June 2023.

Fast-forward to now … August's tech sell-off and NVDA's rising valuations have created some headwinds to its overall rating, but the stock remains “Bullish,” meaning the stock should beat the broader market by 2X over the next 12 months.

But will it continue this incredible run?

Over the last three years, NVDA stock has rocketed up 465.5%. Compare that to the U.S. BMI Information Technology Sector Index gain of 44% and the S&P 500 gain of 24%.

The big data point: Since turning “Bullish” in the first week of June 2023, NVDA is up 223%. And it still rates well in our system as the AI mega trend continues to grow.

To think, all of this may not have happened had it not been for a casual breakfast between three friends in a corner booth of a San Jose Denny's.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

The post Innovation With a Side of Bacon (NVDA Stock Journey) appeared first on Money & Markets, LLC.